Barclays Bank UK

Banks

A refresh of one of world’s most recognized brands. Branch audit and recommendations for a sustainable retail platform.

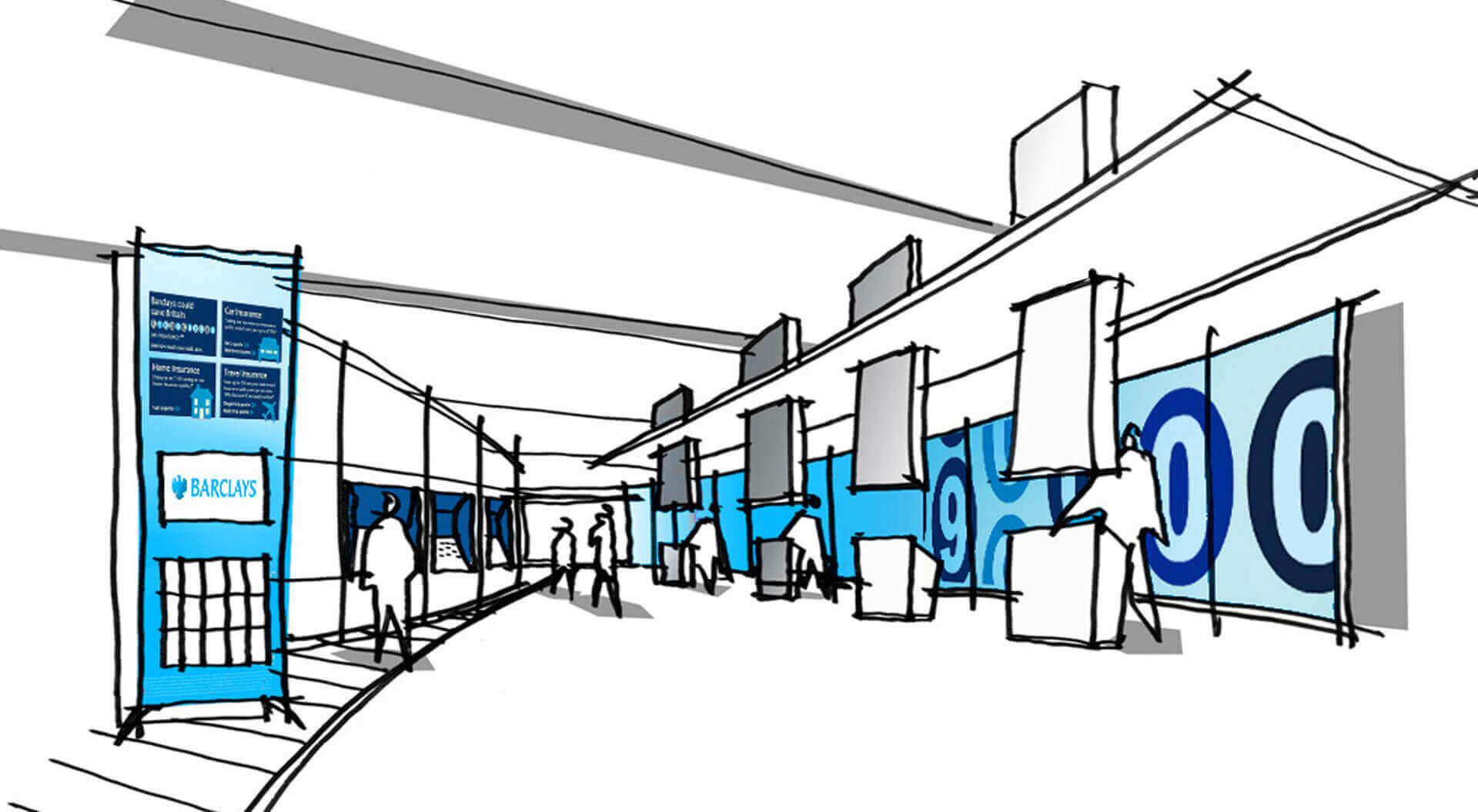

A multi-channel consumer- centric lifestyle study for a bank branch transformation programme. Seeking a sustainable retail platform for the future.

An audit across different brick-and-mortar formats of Barclays retail branch network. They reassess their branch footprints and how they will run their branches moving forward with digitization and innovation.

You don't run a business hoping you don't have a recession

What does Campbell Rigg consider when preparing a brand and bank branch audit?

Consideration is given to the design and layout of the existing property estate. A bank needs to work with what it has. The proposals should give the option to improve the branch network within a phased approach, minimising initial cost outlay. All recommendations need to be based upon sound insight into customer shopping behaviour.

Barclays core brief:

What do we want to interrogate within the proposal?

We want to look in depth at all the following elements of the branch environment:

Branch Location / Positioning

Property Style

External Signage

Window Marketing and Best use of windows

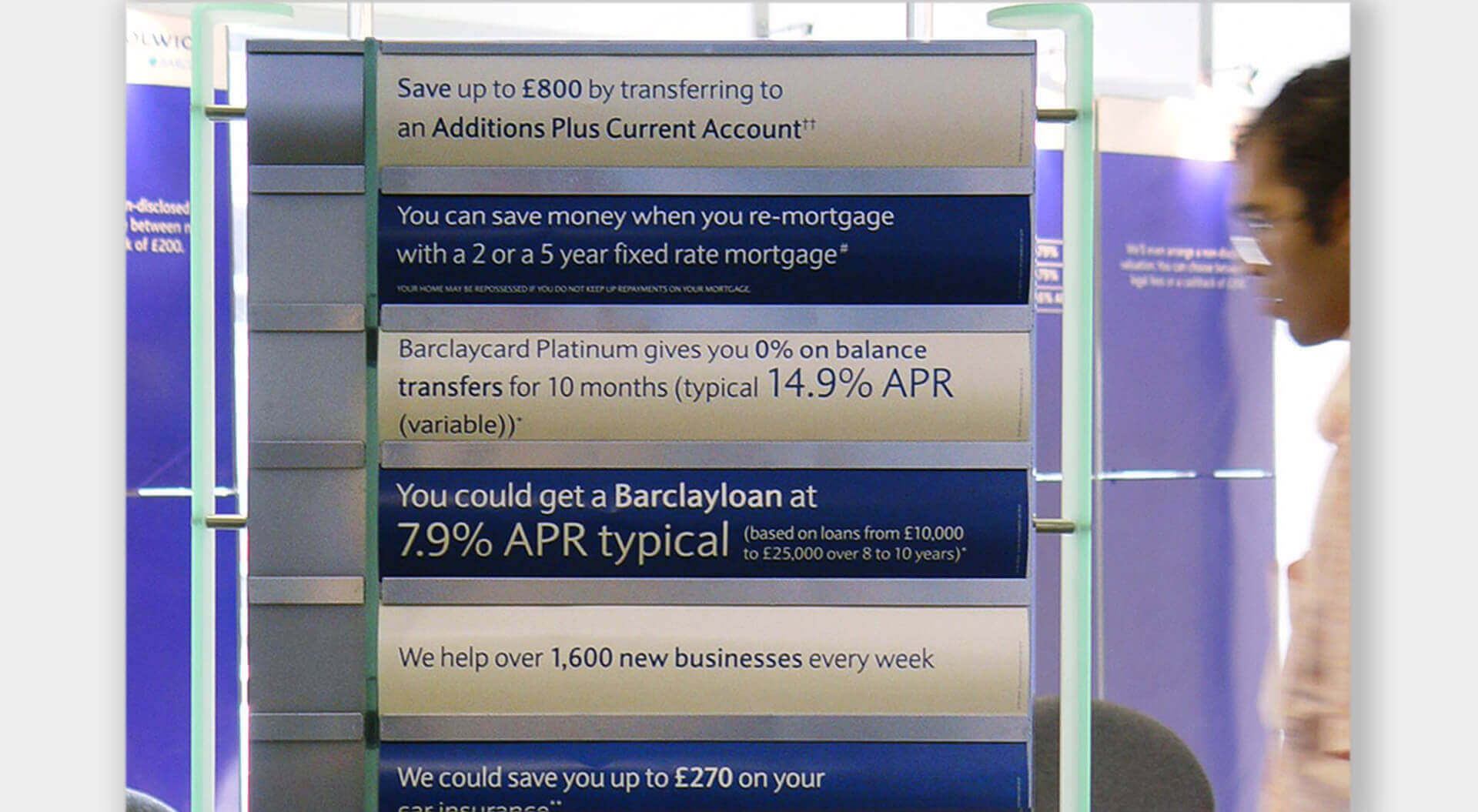

In branch Marketing:

Posters and the benefits/pitfalls of local flexibility

Leaflets both tactical / and nontactical

Tactical promotions

Just the facts (JTF’s) Our core range of literature

Life stage literature

Magazines

Under counter product and fulfilment literature

Merchandising of Impulse products

Promoting our day-to-day products and services

Signage

Local Marketing

What do we expect to see within the proposal?

Consumer insight into how customers shop financial services.

What our competitors do that works / doesn’t work.

What works well within our existing branch network?

What quick fixes we could make.

What long-term changes do we need to make

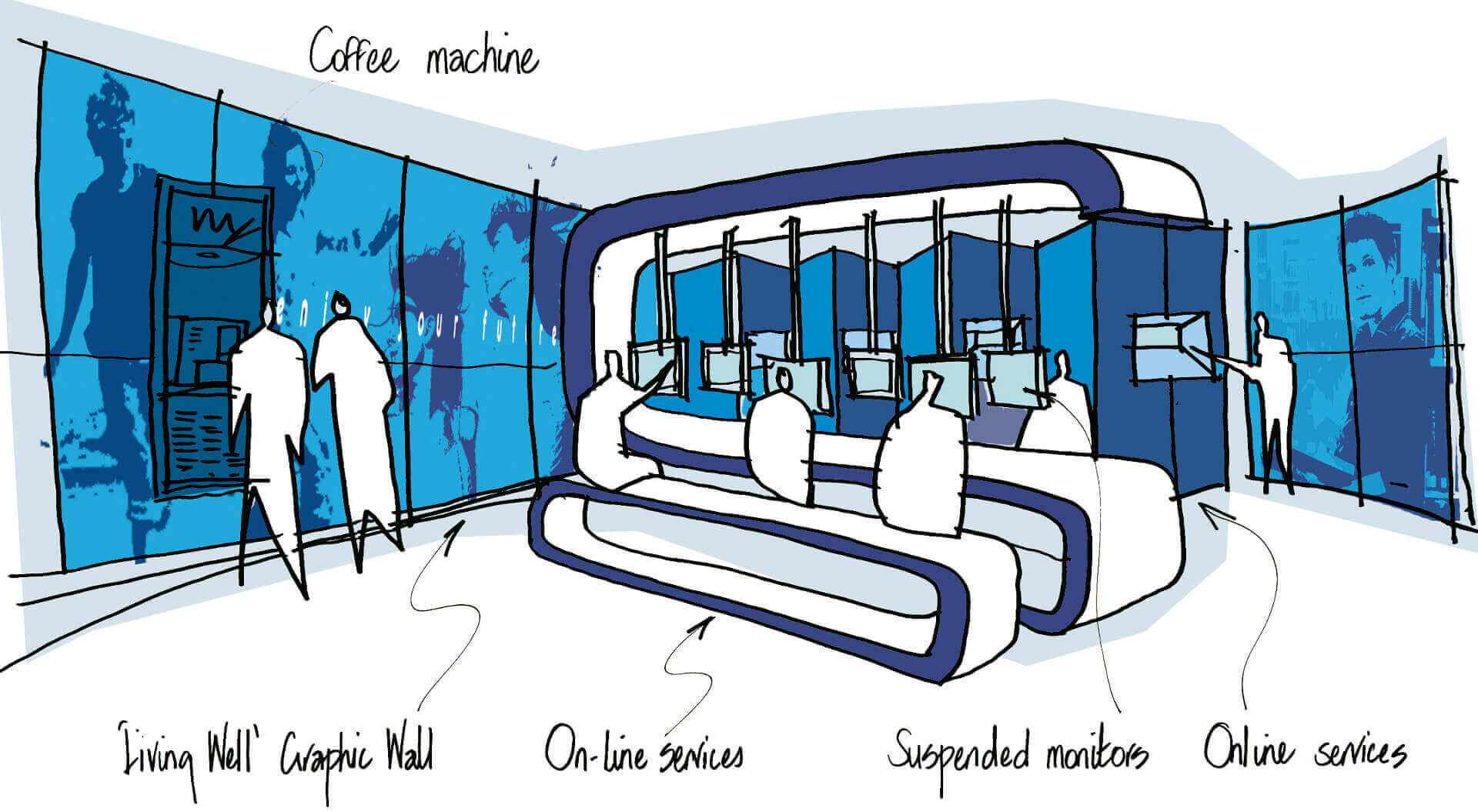

New technology

How will we measure the success of the proposal?

By the submission of an achievable, cost effective, practical solution from which we can see a benefit for both staff and customers with the potential for increase return on investment and brand warmth.

Banks Face Big Risks Shrinking Branch Networks as Pandemic Recedes. As this process of retail rethinking continues, against a backdrop of tougher times for consumers, businesses and financial institutions, there is one encouraging point for financial marketers. "Top-line growth is strongly tied to marketing spend." We analyse cluster group segments, customer journey times for shopping missions, the brand, the selling environment moving to an appointment-only model, impact of interior design, lighting, cashiers, waiting and self-service areas, cross-selling opportunities, digital signage and marketing.